by Iver van de Zand, SAP

The end of the year is always a time to reflect, but also a time to look ahead and think about what might be different or innovating next year.

Reflecting on 2015, three things immediately come to mind:

- Interactive self-service business intelligence (BI) has definitely landed and earned its permanent place. Every top-100 customer I talked to has self-service business intelligence in its BI strategy plans.

- “Traditional” business analytics (as in managed reporting and dash boarding) is not sufficient anymore for full performance management. A closed loop portfolio of analytical, predictive, planning, and GRC information is becoming a necessity in today’s management of processes and business flows.

- The value of in-memory platforms is now being recognized by leading companies. They massively adopt in-memory platforms to not only run their core applications, but also to integrate business data and facilitate analytics.

Looking forward, I’m sure you’ll agree with me that analytics is heavily influenced by the readiness of organizations to adapt to change resulting from the Digital Transformation. Connected economies and networks, data that’s available at any moment at any level, and sensor techniques allowing for new business models—they all heavily influence our needs for insights. As such, they heavily influence the 2016 trends for business analytics.

Did Tableau Lose Its Head?

Recently, I did the Google search exercise for “BI Trends 2016″and was both shocked and amazed. Our friends from Tableau’s marketing department have succeeded in monopolizing 80% of the first 20 hits! However, if you read closely, you’ll notice they are all referring to the exact same article. (Though they all seem to be different articles, they all cover identical things.)

I was further shocked by the lack of insights these identical articles cover. My feeling is that the articles point out BI trends for 2014 (or earlier). “Governance and self-service become best friends,” it says. Dear people from Tableau, self-service BI can only exist by the sake of data governance. If self-service BI is not governed properly, there is no sense for it. And the trend mentioned as “Data Integration gets Exciting”? This was something everybody focused upon in 2012.

Analytical Projections for 2016

So what can we expect for 2016? Personally, I can only reflect on what I see and hear when talking analytics with key customers every single day. For me, these discussions have provided food for thought. Listening to the plans that my customers have, I can extract five key trends for business analytics in 2016:

- Self-service BI will become a commodity

- Business will embrace the portfolio loop

- Companies will really analyze Big Data

- Cloud BI adoption will accelerate

- Operational BI footprint will grow

Let’s take a closer look at the first two trends in today’s blog.

- Self-Service BI Becomes Commodity

Governed self-service BI will further find its way to all echelons of organizations. And the reason is simple— business users finally have the opportunity to drive analytics in their organizations. While 2015 was the year of adopting self-service BI, 2016 will be the year of the massive roll-out. Self-service BI is becoming a commodity in 2016 with the number of business users growing rapidly. From a functional perspective, the success of self-service BI is greatly determined by its ability to:

● Interact with the user. Self-service BI can be adopted quickly because end users are able to interact with massive amounts of structured and unstructured sources of information.

● Make data and insights easily visible. Business users really recognize the value of making insights visible. The simple but clever idea of using visualizations and analyses to create your own stories (storytelling and infographics) is very successful. Nice examples are GEO-driven stories, dashboards , and D3 open- source visualizations. These, combined with interactivity, make self-service BI a stunning combo. As I’ve mentioned before, “our meetings will never be the same.” We can now use interactive, visualized insights to discuss and monitor the heartbeat of our company in real time!

● Be agile with new and ever-changing data. A third success factor (what’s in a name J) to self-service BI is its agility. This agility is a huge value-add because it allows business users to really simply acquire and enrich new data and use it for analyses. Bear in mind, this also applies to Big Data using in-memory computing.

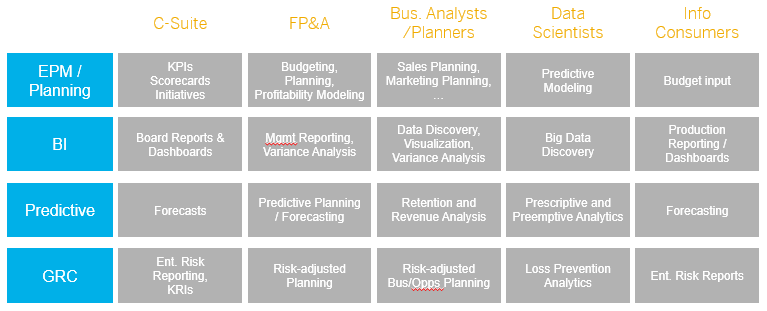

- Business Embraces the Portfolio Loop

I’ve made my point on the importance of the closed loop portfolio in earlier blogs. Every key customer I met last year who’s willing to embrace Digital Transformation is seeking an integrated and governed platform to analyze, plan, predict, and assess risks in a constant and permanent loop.

I use the word ‘integrated’ on purpose here, since here is where the difference is made—customers seek to have real-time integration between their business analytics, their detailed planning, and the predictive models that affect, for example, product mix or pricing strategy. The integration also needs to be on operational financials and towards risks and compliancy cases when needed.

Many of my customers have accomplished this on a near-integrated level that isn’t real time by using individual components that access each other’s data. Products like SAP Cloud for Analytics are revolutionary here since they provide the closed loop portfolio covering real-time, interactive integration on all mentioned areas. Markets have been waiting for this for quite some time and are eager to adopt. It allows them to interact with market fluctuations that speed up due to the Digital Transformation. You can look at the examples I described in a previous blog for the retailing sector to understand the scope of the closed loop portfolio.

Stay tuned for my next blog. I’ll discuss the other three trends I see for business analytics in 2016: analyzing Big Data, the acceleration of cloud BI, and the growth of operational BI.

Follow me on Twitter @IverVandeZand.

Amick Brown is here for you.